installment open end credit example

Home mortgages car loans and student loans are the most common examples of installment credit. View Test Prep - Open End Credit examples from MATH 140 at Colorado Technical University.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

Other examples include mortgages Mortgage A mortgage.

. Installment Loans and Open-End Credit. A mortgage loan from a savings and loan institution. Installment credit is when you borrow a specific amount of money from a lender and agree to pay off the loan in regular payments of a fixed amount over a specified time period.

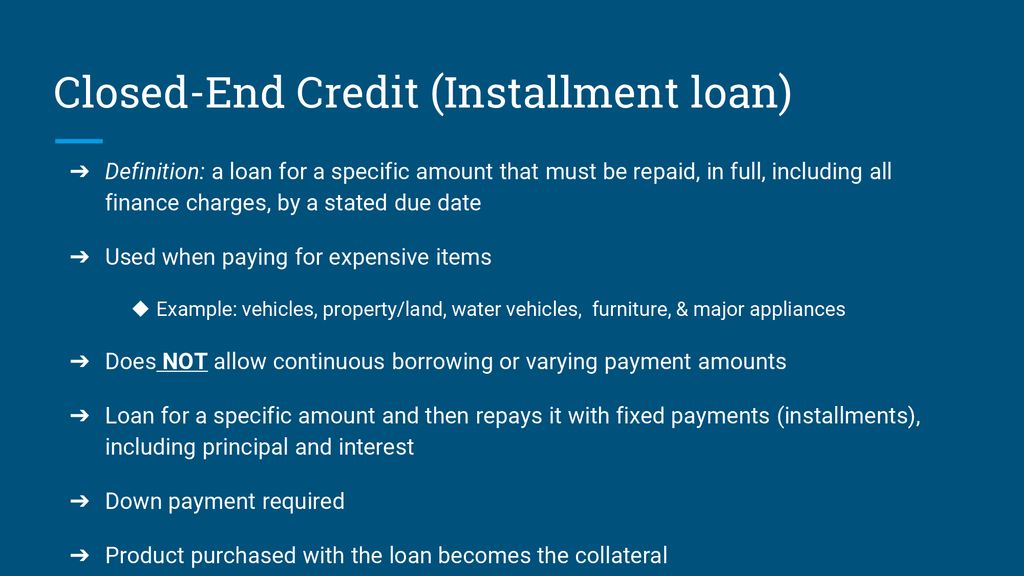

View the full answer. Yes an installment loan is a perfect example of closed-end credit since the amount must be paid off in full by a specified date in the future. Examples of installment loans include mortgages auto loans student loans and personal loans.

C Travel and entertainment cards. A good example of an open-end credit is. Good examples of installment loans traditionally include.

C automobile loan from a credit union. Closed end credit is offered by financial institutions often referred to it as an installment loan or a secured loan. Depending on the product you use you might be able to access the funds via check card or electronic transfer.

The use of a bank credit card to make a purchase. An example of open-end credit is mortgage loans as there are specific open end mortgage loans available so correct option will be C mortgage loans Automobile loans and revolving check credit are closed ended loans. D installment loan from a furniture store.

Types of Installment Loans. B the mortgage loan from a savings and loan institution. Open end credit.

The lender provides the borrower an amount equivalent to the cost of the motor vehicle. For example if a consumer obtains credit life insurance that is. A typical car loan checks all of the boxes of.

Ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages. Bank in the amount of 7200. Another source of credit is credit card companies like visa mastercard American express and discover.

E A credit card. Open-End Unsecured An unsecured open-end loan is a. C automobile loan from a credit union.

E the use of a bank credit card to make a purchase. Similarly what is the difference between closed end credit and open end credit quizlet. With a closed-end loan you borrow a specific amount of money.

C A bank line of credit. A written agreement should be made between lender and borrower. Such loans usually come with a loan duration of 12 months to 60 months or more depending on the lender and the loan amount.

Which of the following is an example of closed-end credit. Open End Credit This is a type of credit loan paid on installments in which the total amount borrowed may. Examples of installment loans include mortgages auto loans student loans and personal loans.

Examples of open-end loans are credit cards and a home equity line of credit or HELOC. Terms in this set 30 A good example of an open-end credit is. What is the difference between installment credit and open ended credit.

An auto loan is an installment loan that is borrowed in order to purchase a motor vehicle. CREDIT TYPE 1. A installment loan from a furniture store.

Suppose you get a 775 installment loan and are charged a 100 front-end processing. A credit card and a line of credit LOC are two common forms of revolving. With some forms of open-end credit theres no end date.

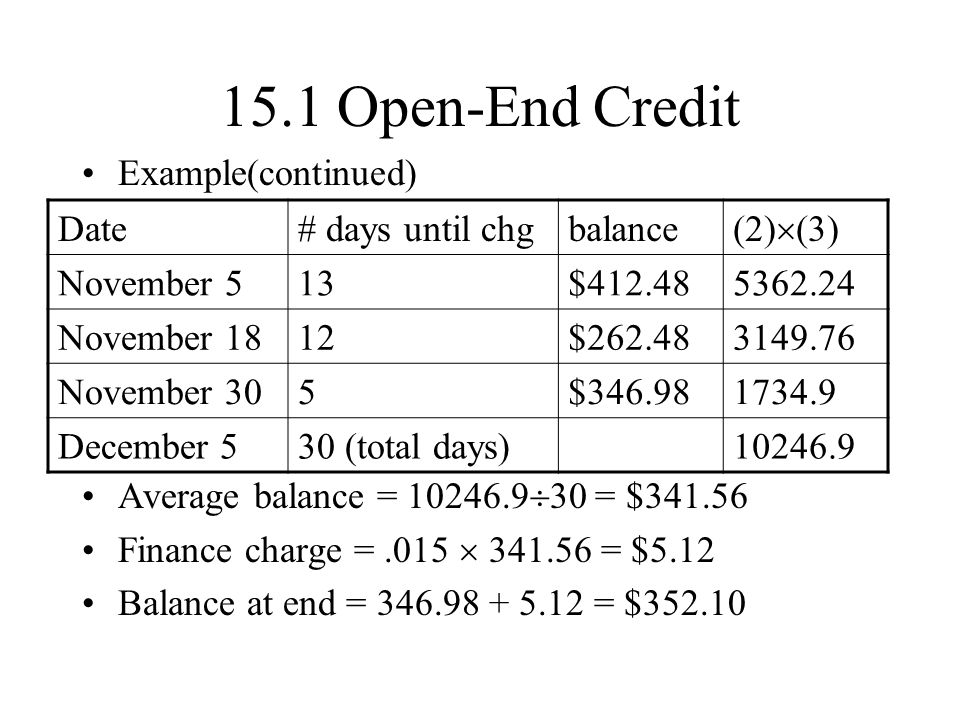

View Test Prep - Open End Credit examples from MATH 140 at Colorado Technical University. An example of an installment loan would be a car loan you are required to pay a set amount of money at a recurring interval ex. A good example of an open-end credit is.

With open-end credit you receive a credit line with a limit that you can draw from as needed only paying interest on what you borrow. Close-end credit is a credit arrangement in which the borrower must repay the amount owned plus. An example of conventiona.

E installment loan for purchasing a major appliance. A good example of an open-end credit is A the use of a bank credit card to make a purchase. Overdrafts and credit card facilities are further examples of open-end credit.

Mindie Hunsaker is thinking about buying a car and getting a 3-year loan from her. Subpart AProvides general information that applies to both open-end and closed-end credit transactions including definitions explanations. Installment loan for purchasing a major appliance.

As you repay what youve borrowed you can draw from the credit line again and again. B the mortgage loan from a savings and loan institution. Common examples of open-end credit are credit cards and lines of credit.

Automobile loan from a credit union. D installment loan for purchasing a major appliance. Auto loans mortgages and unsecured personal loans.

B the mortgage loan from a savings and loan institution. Installment loan from a furniture store. Her monthly payment will be 200 7200 36 200.

To better understand open-end credit it helps to know what closed-end credit means. An example of closed end credit is a car loan. Some open-end credit plans provide that the amount of the finance charge that has accrued since the consumers last payment is directly deducted from each new payment rather than being separately added to each statement and reflected as an increase in the obligation.

In the agreement the total amount of loan interest rate the length of the repayment time and the monthly payments should be mentioned. D Single lump-sum credit. A A department store credit card.

280 per month until the loan is paid off in full. Credit cards and credit lines are examples of revolving credit. Regulation Z is structured accordingly.

B An installment cash credit. Credit card accounts home equity lines of credit HELOC and debit cards are all common examples of open-end credit though some like the HELOC have finite payback periods. Open-end credit also is referred to as a line of credit or a revolving line of credit.

The issuing bank.

What Is Open End Credit Experian

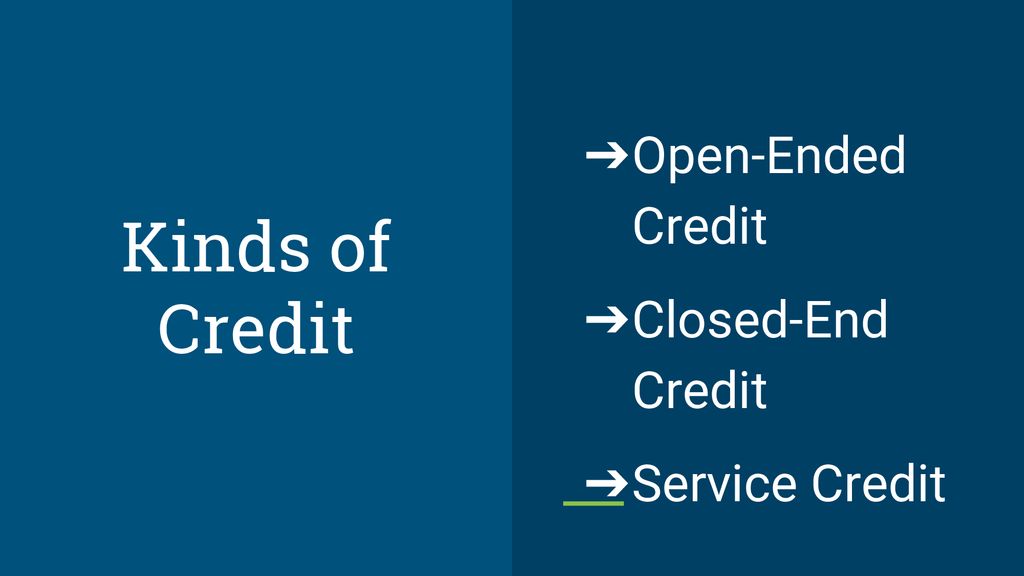

Lesson 16 2 Types Sources Of Credit Ppt Download

What Are Three Types Of Consumer Credit

What Is A Credit Utilization Rate Experian

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

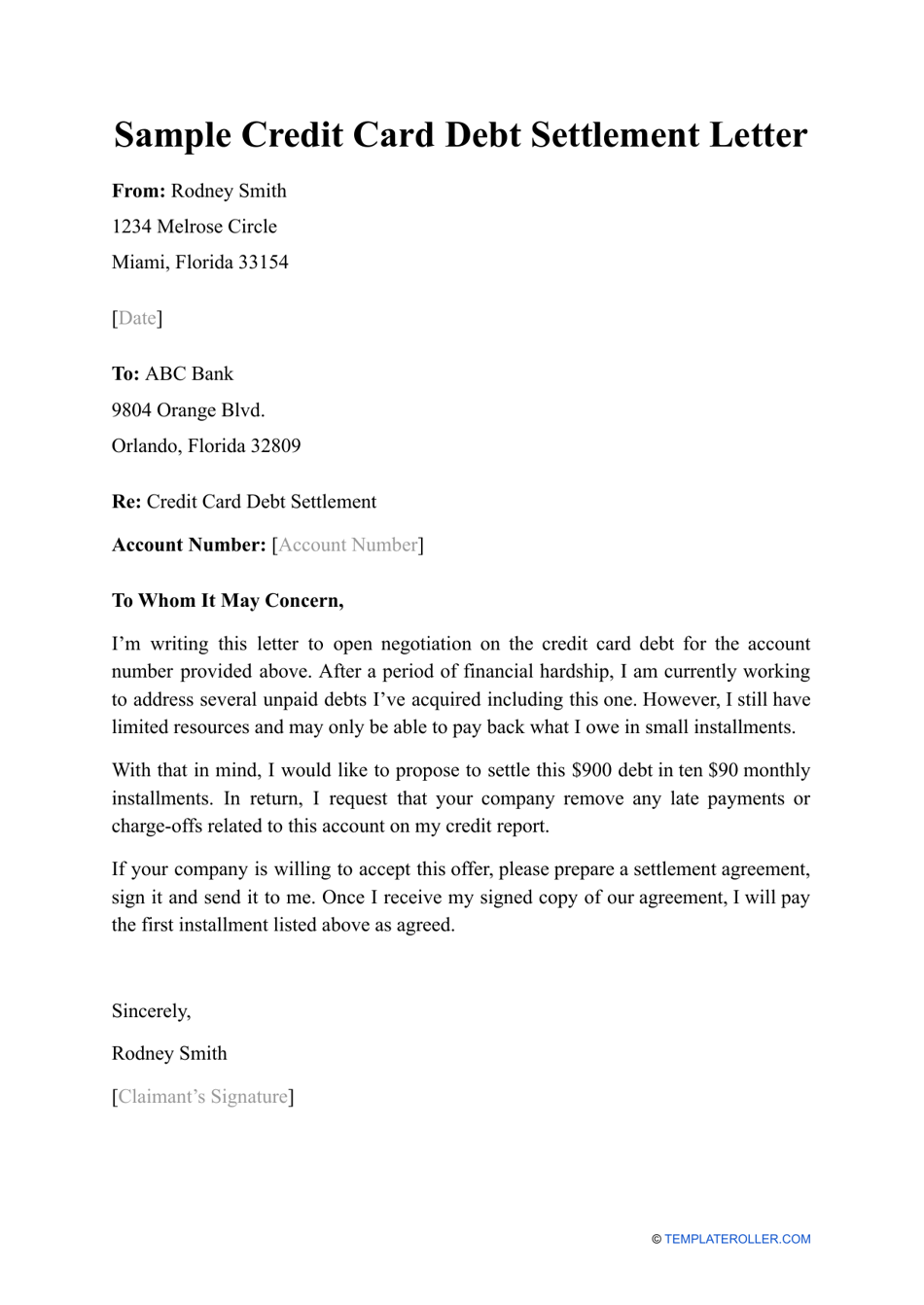

Sample Credit Card Debt Settlement Letter Download Printable Pdf Templateroller

Lesson 16 2 Types Sources Of Credit Ppt Download

Lesson 16 2 Types Sources Of Credit Ppt Download

What Are Three Types Of Consumer Credit

Accepting Card Payments In Installments Stripe Documentation

Sample Credit Card Debt Settlement Letter Download Printable Pdf Templateroller

13 1 Compound Interest Simple Interest Interest Is Paid Only On The Principal Compound Interest Interest Is Paid On Both Principal And Interest Compounded Ppt Video Online Download

Line Of Credit Vs Installment Loan Moneykey

Types Of Credit Definitions Examples Questions

Math In Our World Section 8 4 Installment Buying Ppt Video Online Download

Understanding Different Types Of Credit Nextadvisor With Time

Open End Credit Definition Bankrate Com

Installment Loans Revolving Credit How To Manage Your Debt

Revolving Credit Vs Installment Credit What S The Difference